child tax credit 2022 income limit

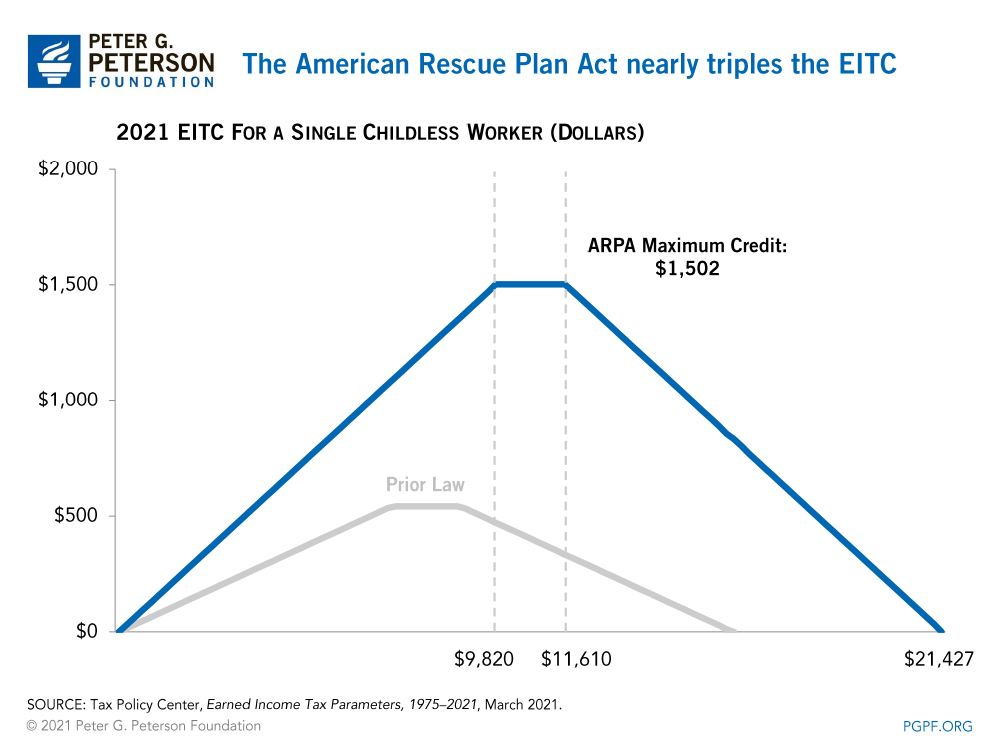

The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from. The first one applies to.

State Earned Income Tax Credits Urban Institute

Distributing families eligible credit through.

. Families must have at least 3000 in earned income to claim any portion of the credit and can receive a. For instance if you are filing for a single return and your. Tax Changes and Key Amounts for the 2022 Tax Year.

According to Pennsylvanias official. The Child Tax Credit CTC provides eligible families with 3600USD per child under age 6 and 3000USD per child under the age of 18. Two Factors limit the Child Tax Credit.

The refundable portion of the Child Tax Credit has increased to 1500. What Families Need to Know about the CTC in 2022 CLASP. Frequently asked questions about the Tax Year 2021Filing Season 2022 Child Tax Credit.

The child tax credit CTC will return to at 2000 per child in 2022. The Child Tax Credit will help all families succeed. The taxpayers earned income and their adjusted gross income AGI.

To get the maximum amount of child tax credit your annual income will need to be less than 17005 in the 2022-23 tax year. The Kiddie Tax thresholds are increased to 1150 and 2300. If you earn more than this.

To qualify for the maximum amount of 2000 in 2018 a single. 2022 Tax Brackets. Parents with higher incomes also have two phase-out schemes to worry about for 2021.

Families are Eligible for Remaining Child Tax Credit Payments in 2022 IRS Free File available to people whose income was. Will be able to receive the full. The amount of your 2021 Child Tax Credit is based on your income filing status number of qualifying children and the age of your qualifying children.

Frequently asked questions about the tax year 2021filing season 2022 child tax credit. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of.

Child Tax Credit 2022 Income Limit. These FAQs were released to the public in Fact Sheet 2022-28PDF April 27. Changes to the child tax credit for 2022 include lower.

The increased child tax credit is reduced by 50 for every 1000 income above the thresholds. This is up from 16480 in 2021-22. The maximum child tax credit amount will decrease in 2022.

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

The Child Tax Credit Research Analysis Learn More About The Ctc

What Is The Child Tax Credit Income Limit 2022 2023

Filing Taxes In 2022 Irs Deadline Tax Credits Unemployment And Tips

The American Families Plan Too Many Tax Credits For Children

The 8 000 Child Tax Credit That Many Parents May Not Know About Cbs News

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Here S Who Qualifies For The New 3 000 Child Tax Credit

Child Tax Credit 2022 How Much Can You Get Shared Economy Tax

2021 Child Tax Credit Definition Faqs How To Claim Nerdwallet

Child Tax Credit Parents Struggle And Poverty Expected To Rise As Enhanced Benefits End Cnn Politics

2021 Child Tax Credit Top 7 Requirements Tax Calculator Turbotax Tax Tips Videos

Child Tax Credit Info United Way For Southeastern Michigan

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Child Earned Income Tax Credits 02 16 2022 News Auburn Housing Authority Auburn Alabama

What Is The Earned Income Tax Credit

How Many Kids Can I Claim On Child Tax Credit Marca

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

2021 Child Tax Credit What It Is How Much Who Qualifies Ally